Understanding Community Foundations

Community foundations pool resources from individuals, families, and businesses to support nonprofits within their communities. It all starts with a donor or donors working with us to establish a fund to support their charitable goals. We currently manage nearly 400 different funds totaling approximately $140 million. Most of those funds are restricted to support specific organizations or areas of interest.

Our Grantmaking Process

- Identifying Community Needs: Our team of program officers, each of whom is an expert in her area of focus, starts by identifying the most pressing needs within the community and managing their related portfolio of funds. This involves engaging with local stakeholders and analyzing data to understand where support is most needed.

- Establishing Grant Programs: Based on identified needs, our team established five areas of focus: Arts & Culture, Education, Environment & Energy, Health & Human Services, and Neighborhood Vitality.

- Endowments: To support our grantmaking activities, the Community Foundation relies on donations from the public. Most of the funds that we manage are endowed funds, which are invested to generate income for long-term grantmaking. This ensures a sustainable source of funding for future grants.

- Grant Application and Review: Nonprofit organizations seeking funding submit grant applications detailing their projects and how they align with the foundation’s priorities. Applications are reviewed by a committee and/or foundation staff to assess their potential impact and feasibility. Committee members are selected because they have a connection to the fund or expertise in the area it supports.

- Awarding Grants: Once the review process is complete, the foundation awards grants to selected nonprofits. These grants can be unrestricted, allowing organizations to use the funds as needed, or restricted to specific projects or programs.

- Monitoring and Evaluation: After grants are awarded, our program officers monitor the progress of funded projects. This involves regular reporting from grantees and site visits to ensure that the funds are being used effectively and that the projects are achieving their intended outcomes.

- Community Engagement and Feedback: Continuous engagement with the community is crucial. Foundation staff often holds meetings, site visits, and forums to gather feedback and ensure that our grantmaking strategies remain aligned with community needs and our mission.

Our grantmaking is made possible by the funds that have been established over our 31-year history. Each fund was established based on the interests and passions of the donor(s), and it is our honor and obligation to abide by the parameters set forth by our fund holders.

There are different types of funds that donors can establish with the Community Foundation:

- Undesignated: Want to meet the most pressing needs in Berks County? Grants from undesignated funds are determined by our board of directors to address ever-changing community needs. This type of fund supports initiative work such as our support of Spotlight PA, student retention work, rural initiatives, and new arts funding. We strategize to use unrestricted funding to create systemic change and address big issues.

- Designated: Support a specific organization year after year, even after you are gone. Organizations benefit from consistent support, and you can be confident the money in your fund is professionally managed.

- Field of Interest: Whatever your cause, our team of program experts will do the legwork to ensure grants from your fund make a difference for your cause now and for years to come.

- Donor Advised: Make decisions about where grants from your fund go each year while you are alive, with the option to name a successor advisor after you are gone.

- Scholarships: Help students pay for their education through a scholarship fund. Or use a designated fund or more flexible field-of-interest fund to support a specific school or area of education.

- Giving Circle: The Power of the Purse (POP) committee is a women’s giving circle. The dedicated group of women meets several times a year to learn about barriers women and girls face in Berks County. They visit local organizations, listen to expert speakers, and make thoughtful decisions about how best to help, using their pooled resources.

The vision for the Program Team is to:

- Move the needle in priority areas where donors and/or the community have asked us to shine a light.

- Develop deep expertise in these priority areas and make strategic investments of time, effort, and money to improve the quality of life in Berks County in those areas.

- Be impeccable in the stewarding of grants to ensure donor intent is met and data and feedback are collected and put to good use.

I lead the team of expert program officers, ensuring their grantmaking work and management align with donor intent. Together, we seek local and national partnerships and opportunities to amplify the impact of our programs.

The mission of Berks County Community Foundation is to promote philanthropy and improve the quality of life for the residents of Berks County. We play a pivotal role by providing financial support to various nonprofit organizations and individuals in need through our grantmaking. If you have questions, please email me at monicar@bccf.org.

READING, PA (April 9, 2025) – Berks County Community Foundation is pleased to announce the conclusion of its 1st quarter grant cycle for calendar year 2025, which has successfully distributed vital funding to local nonprofits and initiatives dedicated to improving our community.

In this quarter, the Foundation awarded grants to a diverse range of projects focusing in areas of environment and energy, education, health and human services, arts and culture, and neighborhoods and economic development; supporting the impactful work of local organizations that improve the lives of Berks County residents.

These numbers are a testament to the Foundation’s commitment to its mission to promote philanthropy and improve the quality of life for the residents of Berks County.

- Q1 total grants awarded: 190

- Q1 total dollar amount awarded: $1,152,270

- Q1 number of organizations impacted: 142

“Grants awarded are made possible by generous donors who give back to the community they love,” stated Molly McCullough Robbins, Vice President for Philanthropic Services.

Moving forward, community members are invited to join the Community Foundation in sparking change. Here are two ways to get involved:

- Give to an Existing Fund: Your contributions can help sustain the important work of established funds addressing specific needs within Berks County.

- Create Your Own Fund: Whether you want to honor a loved one or support a particular cause or organization, the Foundation can help you to create a fund that reflects your passions and philanthropic goals.

For more information on how to give or create a fund, please visit www.bccf.org, email Molly McCullough Robbins at mollyr@bccf.org, or call (610) 685-2223.

###

Berks County Community Foundation is a nonprofit corporation serving as a civic leader for our region by developing, managing, and distributing charitable funds to improve the quality of life in Berks County, PA. More information is available at www.bccf.org.

On March 29, 2025, approximately 145 guests gathered at the Berkshire Country Club to honor Ramona Turner Turpin with the 2025 Thun Award. The Thun Award was created in 1988 to honor Louis R. Thun and Ferdinand K. Thun, local industrialists and philanthropists, in recognition of their long-standing record of civic and community service. The award is presented to Berks County residents whose commitment of time, leadership, and philanthropy exhibits the enduring sense of community reflected by the high ideals of the Thun family.

Fulton Bank and Berks County Community Foundation proudly presented the 2025 Thun Award to Ramona Turner Turpin for her extraordinary community contributions, engagement, and philanthropy in Berks County. Ramona is an Instructor at the Literacy Council of Reading-Berks. Early in her career, Ramona was employed by Berks County Intermediate Unit – first as a teacher, then as an early childhood education coordinator. She served as the Dean of Leadership and Director of Funds Development for the I-LEAD Charter School in Reading. Ramona’s banking career began as the Community Reinvestment Act Director for Bank of Pennsylvania before she was named Community Relations manager for Sovereign Bank in 1999, a position she held for almost ten years. In addition, she held the role of Small Business Specialist for three years.

Ramona has served on numerous boards, including Berks County Community Foundation, Reading Musical Foundation, Olivet Boys and Girls Club, BCTV and United Way of Berks County. She has volunteered her time with Berks Intercultural Alliance. Ramona is a long-time member of Bethel African Methodist Episcopal Church where she has shared her time and talents as a teacher, choir member, and Christian education director; she presently sits on the steward board. Ramona has received numerous awards, including the Athena Award, the Outstanding Woman award from Girl Scouts of Eastern Pennsylvania, the Amiga Award from the Latina Gathering, and the NAACP Image Award.

Previous Recipients of the Thun Award:

- 1988: Ferdinand K. Thun and Louis R. Thun

- 1989: Gertrude Sternbergh

- 1990: H.O. “Mike” Beaver

- 1991: Eugene L. Shirk

- 1992: Severin Fayerman

- 1993: Albert Boscov

- 1994: Paul and June Roedel

- 1995: Sidney and Barbara Kline

- 1996: Samuel A. McCullough

- 1997: Dr. Charles A. Carabello

- 1998: John F. Horrigan Jr.

- 1999: T. Jerome and Carolyn Holleran

- 2000: P. Michael Ehlerman

- 2001: Robert W. Cardy

- 2003: Thomas P. Handwerk

- 2004: Karen A. Rightmire

- 2005: David L. Thun

- 2007: DeLight E. Breidegam

- 2008: Gordon G. Hoodak

- 2013: C. Thomas Work

- 2014: Irvin and Lois E. Cohen

- 2015: The Honorable Arthur E. Grim and Louise C. Grim

- 2016: Christ “Chris” G. Kraras

- 2017: Carole and Ray Neag

- 2018: Carl D. and Kathleen D. Herbein

- 2022: Julia Klein and Eric Jenkins

Thun Award recipients are community advocates who are leaders in commerce and industry. This year’s award recipient embodies the passion for and investment in this community, qualities that are found in all the recipients of the Thun Award.

Berks County Community Foundation established the Thun Award Fund from which honorees recommend grants to organizations of their choice. Ramona selected The Sisterhood of Reading to receive this year’s grant. The Sisterhood of Reading strives to foster a kindred and caring spirit among African American women. Their goal is to mentor young women for the betterment of our community.

Click here to view event photos from the Celebration of Giving and Thun Award presentation. To view the video which highlights Ramona’s contributions to the community, visit our YouTube page here. For more information about the Thun Award, please email me at mollyr@bccf.org.

Thanks to the generosity of our community, Berks County Community Foundation now manages nearly 400 funds totaling over $140 million. Since we were founded in 1994, donors have worked with us to establish these funds to support the causes and organizations that are most important to them. Are you interested in giving back to your community? Sparking change in Berks County starts with defining your charitable goals. We can help you achieve those goals, no matter the cause or motivation. Let us help make a difference to what matters most to you.

One way to spark change is to determine how you want to support the community. What causes interest you most? We have created a short questionnaire to set your journey of generosity in motion. The questionnaire starts by asking, “What do you hope to achieve with your fund?”

Different funds fulfill different charitable goals. When you create a fund with Berks County Community Foundation, do you want grants from your fund to support:

- A variety of community needs as determined by the Community Foundation

- A specific organization (or multiple organizations)

- A cause I care about, not a specific organization

- Different nonprofits that I select each year

- Individuals seeking an education

- Individuals who excel at something

Once you’ve narrowed down your goals, it’s time to talk to us. We will work with you to draft a fund agreement which details your wishes and eligibility parameters for future grant recipients from your fund.

In this three-part series, we will explore endowment funds, sparking change, and grantmaking. At Berks County Community Foundation, we do all three. Whether you’re a nonprofit leader, philanthropist, or community advocate, this series will provide insight into how strategic funding can shape a better future.

If you have questions, please email me at mollyr@bccf.org or call 610-685-2223. I look forward to hearing more about you and how you would like to spark change in our community.

Over the past 30 years, we have built strong relationships that form our network of donors, fundholders, grantee organizations, supporters, and community leaders. That network is essential to our ability to operate and fulfill our mission to promote philanthropy and improve the quality of life for the residents of Berks County. To better serve the community, we want to understand what matters most to our constituents and supporters.

With that in mind, we created a short survey to gather insights into the interests of our community. We asked:

- What is your relationship with Berks County Community Foundation?

- Berks County Community Foundation supports the community based on the philanthropic priorities of our donors. What topics interest you most for your potential philanthropic support in our community AND/OR an opportunity to learn about local issues? In other words, to what areas are you most likely to give and/or about which topics would you most like to learn?

- How would you like to learn more about topics that interest you?

- Please select your age range.

A total of 72 community members completed the survey. The results revealed a wide range of interests as well as an appetite to learn more about those topics through various communication channels and events. The most popular topics aligned with areas of focus prioritized by our team of program officers.

We will use the results of the survey to plan future communications and events, including targeted outreach to our constituents to invite them to participate in discussions, lunch & learn events, and other opportunities to engage with us and learn more about the topics that interest them most.

If you would like to participate in the survey, please email mollyr@bccf.org, and I will send you the link. This information will help shine a light on the things that matter to help spark change in your community.

January is “National Thank You Month”— a time to embrace the power of gratitude. Originally established to encourage appreciation after the holiday season, it reminds us to reflect on the kindness and support we receive throughout the year. At Berks County Community Foundation, we don’t really need reminders to be grateful for the support we receive from members of the community – we see examples of this support every day, year-round.

In calendar year 2024, we received over 1,500 donations from 760 donors. In addition, seven new funds were established in 2024, each with specific charitable goals defined by the fund’s founders. Those donations and funds will contribute to the Foundation’s ability to distribute grants and scholarships for many years to come.

To give an idea of the impact made by the donations we receive and the funds we manage, Berks County Community Foundation awarded $6,465,590 in grants to 563 organizations and individuals in calendar year 2024.

Grants awarded are made possible by generous donors who give back to the community they love. Community members are invited to join the Foundation in sparking change. Here are two ways to get involved:

- Give to an Existing Fund: Your contributions can help sustain the important work of established funds addressing specific needs within Berks County.

- Create Your Own Fund: Whether you want to honor a loved one or support a particular cause or organization, the Foundation can help you to create a fund that reflects your passions and philanthropic goals.

For more information on how to give or create a fund, please visit www.bccf.org, email Molly McCullough Robbins at mollyr@bccf.org, or call (610) 685-2223

READING (January 14, 2025) — Berks County Community Foundation is pleased to announce the conclusion of its 4th quarter grant cycle for calendar year 2024, which has successfully distributed vital funding to local nonprofits and initiatives dedicated to improving our community.

In this quarter, the Foundation awarded grants to a diverse range of projects focusing in areas of environment and energy, education, health and human services, arts and culture, and neighborhoods and economic development; supporting the impactful work of local organizations that improve the lives of Berks County residents.

These numbers are a testament to the Foundation’s commitment to its mission to promote philanthropy and improve the quality of life for the residents of Berks County.

- Q4 total grants awarded: 225

- Q4 total dollar amount awarded: $2,120,983

- Q4 number of organizations impacted: 156

“Grants awarded are made possible by generous donors who give back to the community they love,” stated Molly McCullough Robbins, Vice President for Philanthropic Services.

Moving forward, community members are invited to join the Community Foundation in sparking change. Here are two ways to get involved:

- Give to an Existing Fund: Your contributions can help sustain the important work of established funds addressing specific needs within Berks County.

- Create Your Own Fund: Whether you want to honor a loved one or support a particular cause or organization, the Foundation can help you to create a fund that reflects your passions and philanthropic goals.

For more information on how to give or create a fund, please visit www.bccf.org, email Molly McCullough Robbins at mollyr@bccf.org, or call (610) 685-2223.

As 2024 headed to a close, Berks County lost two of its giants.

Like any other community, Berks County has benefited from leaders who stood up, did the hard work of bringing a community together around its challenges and opportunities, and guided efforts to improve the quality of life. Without David Thun and Al Weber, that work will be harder.

David Thun died in a swimming accident on October 31. You would never have known he was 87 years old, given the vitality and energy that he displayed every day. The Thun family has a long and storied history in Berks County, but no one contributed more to that than David. While he was successful in business, I will most remember his contributions to the growth of our community. David was one of the founding members of the board of Berks County Community Foundation. Wading through a list of his community involvements is a dangerous task, as it feels infinite. I remember well his involvement with Berks Nature, the Schuylkill River Greenway, Reading Hospital, Penn State Berks, the Reading Symphony Orchestra, the Reading Public Museum and so many other organizations.

David and his wife Barbara were likely the first people my wife, Kim and I met when we moved to Berks County. They welcomed us and, more than anyone, David helped me learn the lay of the land here. We will miss the way David embodied the essence of a Berks Countian.

While David was the quintessential Berks Countian, Al Weber was not.

Born and raised in Boston, Al, who passed away in late November at the age of 72, never learned that there was an “R” in the word “park.” That Boston accent only added to his credibility as he led almost every nonprofit in Berks County, either as a board member or as a consultant guiding strategic planning.

Al served as Chair of the Community Foundation board from 2020-2023. There was no one’s counsel I valued more. Again, the list of community involvements would go on forever, and our debt to him can never be repaid.

Al’s biggest contribution to the Community Foundation, and perhaps our community, occurred during a staff retreat that he led as a consultant. About half-way through that meeting, Al said, “We need to toss this agenda. Your problem is that you’re trying to lead the community, but you’re charging fees like you’re a bank.”

We tossed the agenda, spent the afternoon figuring out how to create a sustainable business model, and as a result, built what is probably America’s best community foundation. Al’s ability to cut to the chase was unparalleled.

It’s the nature of communities that leaders emerge and, ultimately, leave the scene. Berks County will soldier on. Still, we benefitted greatly from the commitment that David and Al made to this community, and it will be hard to replace them. Our challenge moving forward is to build a community worthy of their trust.

The Early Years

John Scholl was born on August 24, 1947, at St. Joe’s Hospital on 13th Street in Reading, the youngest of two boys. His brother, William, who passed away in December of 2023, was four years his senior. John’s father, William, graduated from Temple University and worked as a pharmacist for his entire career. John’s mother, Emily, was a homemaker and part-time bookkeeper for Bertolette Candies, owned by Walter Lechleitner. They moved around a bit – to Pottstown for a few years before settling in Shillington – and John graduated from Governor Mifflin in 1965.

High School – A Talented Athlete Emerges

Sports have been a huge part of John’s life since elementary school, and he excelled on youth teams. He played baseball until a teacher cut him from the team for being the class clown. John switched gears and tried out for the track team. “I did the broad jump, pole vault and high jump. By the time I was a senior in high school, I was number 2 in high jump, so I had a nice track career.

College years

As a freshman at Albright College, John started playing basketball and became a star player. “Basketball was my main sport – I was on the track team the first two years and played baseball the last two years, but I played basketball all four years.” Basketball was a part of John’s life until he was in his 60s, playing in pick-up games and adult leagues throughout his adult life.

A Budding Businessman

“Ever since I was in high school, I always wanted to be in business for myself. I didn’t care if it was a gas station or a candy store – I just wanted to work for myself:’ That ambition drove the decisions that led to a successful career in the home-building industry. “For two summers during college, I worked for John A. Beard in his office – they knew me from playing basketball. My mother did that company’s books. There were a lot of Albright grads working there at the time. After I got my accounting degree from Albright in 1969, John offered me a full-time job.”

While working full-time for John A Beard, one of the partners, Dick Weidman, took a liking to John and taught him a lot about the business. John was honest from the start about his desire to move out on his own soon, and Dick gave him some great advice. “Dick said, ‘I just want to tell you one thing. There are no bad businesses, only bad businessmen.’ That stuck with me. He said you could have a clothing store that goes out of business, and the next guy buys it and makes it the best clothing store in the area. My success was up to me.”

While working 60 or 70 hours per week at the accounting firm and doing bookkeeping on the side for various clients, John took a job as an accountant and salesperson for Berks Construction Company which had a home-building business called Ridge Homes. John quickly learned the ins and outs of the business, and when the owners decided to sell, John decided to buy the business and work closely with a co-worker, Stanley Ball. The two eventually went into custom home building, a career that spanned decades.

Building Business

Property by property, bit by bit, John built his business while establishing his track record in the community. Early investments were made thanks to help from chance encounters with people who knew John from his time playing basketball at Albright. One night over drinks at Clover Park AA Men’s Club, John ran into an Albright alumnus who knew of John because of his success on the court and offered to help John with the financing to close his first big real estate deal – buying some lots in a new development. “We got to talking. I had this deal half-closed, but I needed money. He financed me and got me started. It was successful for both of us – we both made money:’ That success meant that John could now secure bank loans, and his business grew.

Working long hours, and playing sports at night and on the weekends, John started to get burned out. John got out of the custom home-building business when he was about 40 years old. “I had a lot of properties and enough money for me.”

John Scholl started to think about philanthropy. He established The Scholl Foundation with the help of Tom Williams, a local CPA. John eventually found the government regulations and fees for a private foundation expensive and complicated. Soon after Berks County Community Foundation was established, John worked with Franki Aitken, Chief Operating Officer and Chief Financial Officer, to set up a donor advised fund at the Community Foundation.

“I came in and talked to Franki and said that I’d like to set something up.” He appreciates how easy the process has been for him. “You take care of everything, and all I to do is give the money and say where I want it to go. Every year I always give the maximum that I can give according to the federal government. Then, I call Frankl and say, ‘Send this amount of money to Albright or Reading Hospital’ or to whatever I am interested in doing, and it is so easy.”

The Next Generation

Steven Scholl, John’s nephew, has fond memories of his uncle from his childhood. “I remember at a young age always being drawn to him and looking forward to seeing him. He’d ask me trivia questions about sports or the rules of baseball or football or basketball. He’s always been a teacher to me.” Later, Steven would learn from John by watching him at the homebuilders’ show that used to be held at the Berkshire Mall. “I would watch how he interacted with people. I remember always being amazed at how many people he knew. When I was 16, 17, and 18 years old, I lived with him so I could attend Governor Mifflin High School to play sports, since my parents lived in the Schuylkill Valley School District. I didn’t realize until later what a huge sacrifice that was for him. Here was a guy in his 40s, free to come and go and do whatever he pleased, but he decided to take me in and have a big role in raising me:’ Little did Steven know that this time would help him in business, later in his life.

In 2013, John had open heart surgery and needed help with his business. Steven offered to help and has been involved ever since, taking over the daily property management operations and growing the business. uHe’s very talented – he can build a house from the ground up. He’s good at financing and paperwork and all that kind of stuff, which is difficult. I still do the bookkeeping, but one day he’ll have to take care of that. He’s the perfect match for me.

Looking back, those early experiences are priceless for Steven. “I have had so many times when I called on some of these people I was introduced to by John, and they went out of their way to help me. It was then I realized how much respect they gave him. While he was tough, he treated people fairly. This may be the number one lesson he taught me. ‘Take care of people and they’ll take care of you; he said. This stuck with me, and I’ve tried to live my life that way… always try to do the right thing.”

John later experienced two cardiac arrests – one in 2018 and another in 2023. He is still involved in the business, although his time in real estate is winding down. He relies on Steve to handle most of the business. Steve is grateful for John’s trust and the opportunities he has given him. “I tell everybody, without him, I would be nowhere. Not just the financial part, but the mentoring part, too. If there is one big takeaway from this, it is that he has been my mentor probably a Jot more than he’ll ever know. There is no possible way I could repay him for everything he has done for me. I’d have to live 100 lifetimes. I never want to disappoint him, and I go to great lengths to ensure that doesn’t happen. I often tell people that my father raised me to be tough, to have grit, and to never give up, and John taught me how to use that toughness and grit in the world. Losing him one day will create an enormous void in my life, and I dread when that happens. In the meantime, all I can do is to continue living my life by the example he set and taught me.

John is proud of his funds at the Community Foundation and wishes he could do more. “My funds are eventually going to help a Jot of people – that’s why I like to give back.” Steven will step in as the advisor to the donor advised fund upon John’s passing, per John’s wishes. When asked how he feels about that, Steven reflected, “We share the same values, the same ideas on how things should be. To me, it’s just a matter of continuing his legacy. I’m just steering the wheel, that’s it.”

For more information about establishing funds at the Community Foundation, please contact Molly McCullough Robbins, mollyr@bccf.org, Vice President for Philanthropic Services.

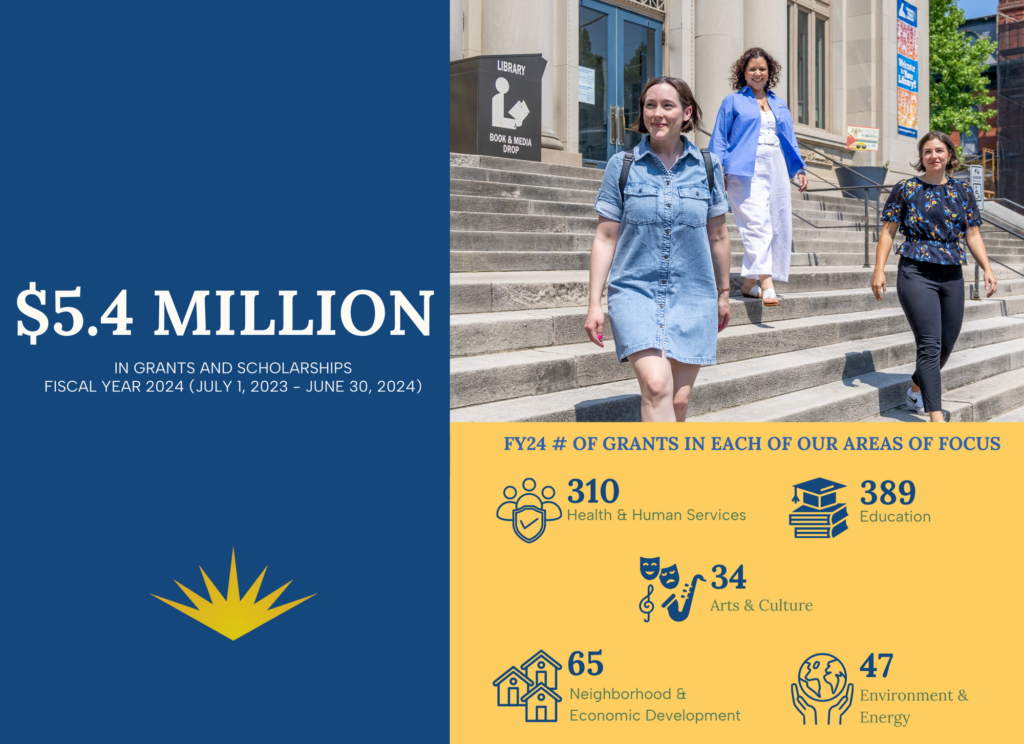

To download our full 2024 Annual Report, please click here.

In Fiscal Year 2024, Berks County Community Foundation distributed $5.4 million in grants and scholarships to support the community. The year was filled with innovative projects, impactful programs and a strong commitment to our mission.

Berks County Community Foundation helps donors fulfill their charitable desires. The Foundation was established in 1994 as a non-profit, public charity to provide a locally managed resource for establishing endowments. We have program officers on staff who are experts in their focus areas – energy & environment, lifelong learning, health & human services, the arts, and neighborhood & economic development. They steward these charitable funds to ensure that the grants and scholarships awarded from them are making an impact and fulfilling our donors’ wishes.

“The work we do isn’t only about working with donors to establish funds. Nor is it just about awarding grants and scholarships. The team at the Community Foundation convenes local leaders, research national and local trends, and chooses initiatives on which to focus so community conversations get moving and big ideas are discussed”, Kevin Murphy, president says.

The Annual Report highlights our mission of promoting philanthropy and improving the quality of life for the residents of Berks County. The team works hard to bring organizations and individuals together for collaboration to spark change in the community. This year’s Annual Report provides detailed stories and data behind these achievements, underscoring the powerful impact of donor support in the community.

To read the full report, take a look below.