You are likely aware that many families, organizations, and agencies in our community are struggling, and you may be wondering how you can help most effectively. Whether increased community needs are triggered by a budget impasse, government shutdown, or other economic factors, the Community Foundation is committed to helping you structure charitable giving plans that make a real difference in the lives of people in Berks County.

Here are a few examples of how our team can help:

Real-time identification of needs.

The program team at the Community Foundation has its finger on the pulse of which organizations are helping families in crisis, and which organizations are hurting the most due to state and federal funding gaps. Nonprofits in our community can be stretched thin by attempting to meet the rising demand for support. The foundation knows where dollars are most needed and how those dollars translate into immediate impact.

Offering fast and flexible charitable solutions.

If you have already established a fund at the Community Foundation, or if you are considering doing so, you can use it to support charities on the front lines in our community.

Leverage important timing.

The urgency of community needs in late 2025 coincides with an important window of opportunity for people who itemize their income tax deductions. Under the One Big Beautiful Bill Act (OBBBA), limits on charitable deductions will tighten in early 2026. That means it may be advantageous for certain donors to give more this year-by establishing or adding to a fund—to maximize both tax benefits and impact.

Plan for the future.

The Community Foundation works with you and other donors and fund holders to strengthen our community’s ability to respond to urgent needs, regardless of when and why they occur.

We encourage you to reach out anytime.

At this moment, when urgent needs and tax opportunities are occurring simultaneously, we encourage you to reach out as soon as possible. It is our honor to work with our community members who care so deeply about Berks County.

Let us help you help others.

What are your plans? What do you need to get started? We’d love to have a one-on-one conversation with you anytime you want to talk.

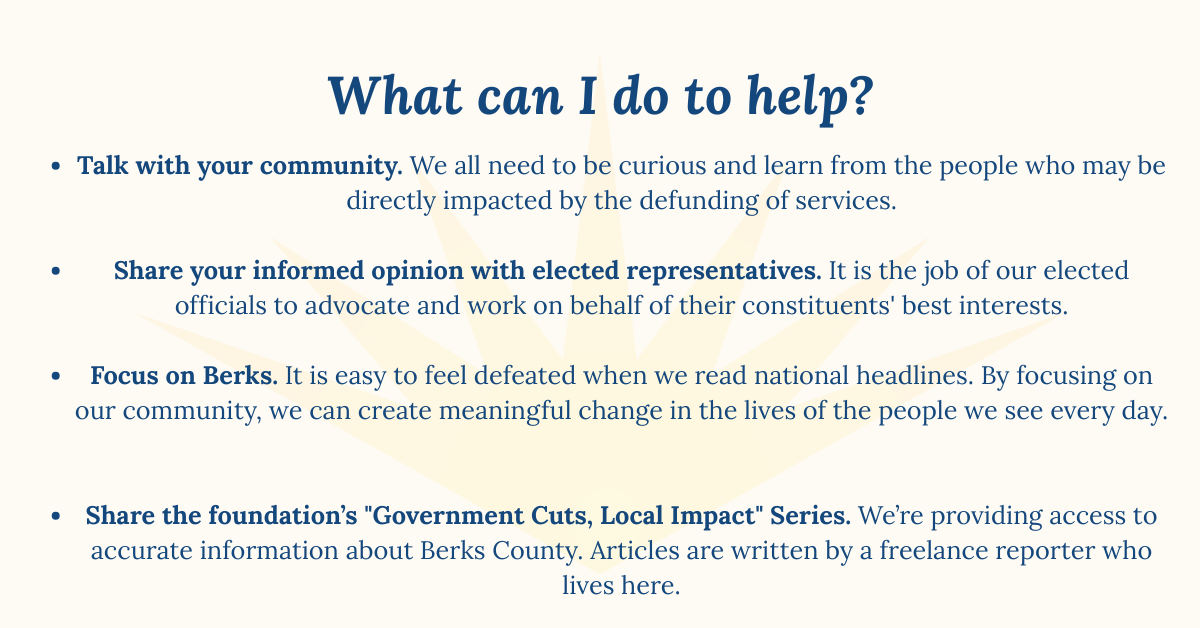

At the Community Foundation, we want to improve life in Berks County by connecting its residents with accurate information.

What do these cuts mean for Berks County residents, nonprofits, businesses and donors?

The impact of federal funding cuts, government shutdowns, and state budget impasse are being felt on a local level.

While philanthropy helps create vibrant and healthy communities, it cannot replace the stability of federal or state investments. Affordable housing, food security, access to education, workforce development, affordable healthcare and much more depend on federal dollars. When that funding is stripped or halted, we risk a reduction in essential local services.

Local philanthropy has never and will never be able to fill the void of government funding.

Why Stories of Impact?

We hear directly from Berks nonprofits, agencies, businesses and individuals how federal cuts impact their capacity to serve the community. To connect Berks County residents with accurate information, we’ve engaged a local freelance reporter to elevate the voices of those impacted. These articles shed light on the real-world effects of these budget changes on local organizations and individuals.

This research has been captured in the form of articles that you can read below.

###

Note from Monica Reyes, VP for Programs and Initiatives:

Opinions expressed in the Government Cuts, Local Impact Series do not necessarily represent those of Berks County Community Foundation.

Click here to read the bio of our reporter, Susan Shelly McGovern

Susan is a freelance writer, editor, and researcher. Over the course of a long and varied career, Susan has crafted thousands of articles, written or contributed to more than 50 books, generated copy for advertising and marketing firms, edited a variety of manuscripts, researched corporate histories and generally applied her skills to whatever projects presented themselves.

But what Susan has enjoyed the most is telling stories.

As a feature writer for the Reading Eagle, area colleges and universities, health care systems, treatment centers and others, Susan has had the opportunity to tell the stories of first-generation college students, people struggling with addiction, veterans, business executives, health care workers, educators, patients dealing with serious illnesses and people who have triumphed over adverse circumstances.

As a long-time, invested resident of Berks County, Susan has witnessed some of the challenges local people experience with food insecurity, homelessness, incarceration, alienation and other extremely challenging situations. She has worked with agencies including New Journey Community Outreach, Opportunity House, Berks Coalition to End Homelessness, Family Promise of Berks County and Connections Work.

Addendum

November 13, 2025: Pennsylvania Governor Josh Shapiro announced late Wednesday night that a $50.1B state budget has been signed into law. The deal ends a four-month budget impasse which stopped the flow of millions of dollars of funding to Berks County schools, nonprofits, businesses, programs and services.

Read the Impact Stories Now

It is our honor to work with so many families and businesses to structure and implement your charitable giving plans.

What’s perhaps most rewarding to the team at the Community Foundation is the overwhelming sentiment among our donors that, despite changes in the tax laws over the years, you are committed to making a difference by supporting the causes you love. Although tax benefits of charitable giving ebb and flow, showing your support for our community and the charities you love through estate planning remains steadfast.

August is National Make-A-Will Month, which means it’s the perfect time to review your estate plans with your attorney and our team at the foundation to ensure your philanthropic intentions are up to date. Even a quick check-in now can maximize the impact of your legacy and help ensure that your wishes are clearly carried out to support the causes you care about for generations to come.

If you are a business owner, the concept of succession/estate planning is nothing new. But succession planning isn’t just for business owners–it’s also important for leaving a charitable legacy. The team at the Community Foundation can help capture your intentions, and we make it easy to involve your family members so that the causes you care about are supported for generations to come.

We look forward to talking with you soon about how you can deepen your involvement with your favorite charities. Our team is here to help.

Tax Law Changes – Time to study up?

Spark Notes is a monthly blog post, providing relevant information to current and future donors and fundholders.

The One Big Beautiful Bill Act was signed into law by President Trump on July 4, 2025, after the House of Representatives approved the Senate’s changes to H.R. 1, which passed the House by a narrow margin in May.

The OBBBA, with nearly 900 pages of provisions, reshapes policy across major sectors of the U.S. economy. Included in the OBBBA are several provisions that impact philanthropy. Three major insights are of particular importance to the Community Foundation. We help donors, fund holders, nonprofits, attorneys, CPAs and financial advisors navigate charitable planning opportunities.

(Notably, the OBBBA omits several provisions that appeared in previous versions of the legislation. These provisions include a proposed increase to the net investment income tax on private foundations.)

Insight #1: Standard deduction goes higher

What’s in the OBBBA?

The new law makes permanent the standard deduction increases under the Tax Cuts and Jobs Act of 2017 (TCJA), increasing the standard deduction for 2025 to $15,750 for single filers and $31,500 to taxpayers who are married and filing jointly. The new law also expands the “bonus” deduction for taxpayers 65 and older through 2028.

Under the new law, individuals who itemize may take charitable deductions only to the extent the charitable deductions exceed 0.5% of adjusted gross income. Furthermore, taxpayers in the top bracket can only claim a 35% tax deduction for charitable gifts instead of the full 37& that would otherwise apply to their income tax rate. Note also that the final bill extended the 60% of adjusted gross income contribution limitation for cash gifts made to certain qualifying charities.

What does this mean for charitable giving?

With even fewer taxpayers eligible to itemize and deductions capped for high-income earners, it’s likely we’ll see the continuing, chilling effect on charitable giving that occurred through TCJA.

What can you do?

If you regularly support charities, continue to do so whether or not you’re benefiting from a tax deduction. Our community needs you, now more than ever. If you’re a nonprofit, attorney, CPA or financial advisor, remember–people do not give to charity solely for tax deductions. Keep in mind that many other factors motivate charitable giving, and philanthropy is an important priority for many families. (This article in the Stanford Social Innovation Review has stood the test of time.)

Insight #2: Deduction for non-itemizers

What’s in the OBBBA?

The new law includes a provision, effective after 2025, allowing non-itemizers to take a charitable deduction of $1,000 for single filers. Charitable deductions for taxpayers who are married and filing jointly are $2,000. As has been the case in the past, gifts to donor-advised funds are not eligible. Unlike a previous (but smaller) similar provision, though, this law is not set to sunset.

What does this mean for charitable giving?

After the TCJA went into effect, households that itemize deductions dropped to under 10%. Parallel to this trend, the number of U.S. adults who give to charity in any given year has dropped over the last 20 years from nearly two-thirds to less than half. Against this backdrop, the OBBBA’s deduction for non-itemizers has the potential to re-motivate charitable giving among a significant number of households.

What can you do?

Now is the time to review your charitable giving plans and support the causes you love. This is especially important if you are early in your career and not yet itemizing deductions. If you’ve already established a fund or already working with the Community Foundation, please reach out. We can help you make the most of the new tax laws, and even get your children and grandchildren involved. If you’re a nonprofit, now is the time to attract and engage brand new donors. If you’re an attorney, CPA, or financial advisor, talk about charitable giving with your clients who don’t itemize. A $1000 or $2000 deduction could be just the motivation they need to begin a journey of philanthropy.

Insight #3: No sunsetting estate tax exemption

What’s in the OBBBA?

For affluent taxpayers and the attorneys, CPAs, and wealth managers advising them, the last couple of years have been turbulent. The looming possibility that TCJA’s increase to the estate tax exemption would sunset by 2026 created a lot of stress. Finally, there is clarity: Under the OBBBA, the sunset will not happen. The new law makes permanent the increase in the unified credit and generation-skipping transfer tax exemption threshold. The 2025 exemption is $13.99 million for single filers and $27.98 million married filing jointly. In 2026, these numbers increase to $15 million and $30 million respectively.

What does this mean for charitable giving?

Purely estate tax-based incentives to give to charity continue to apply only to the ultra-wealthy. This behavior likely resulted in a continuation of the taxpayer behavior triggered by the TCJA. In other words, most people will give to charity for reasons other than a tax deduction.

What can you do?

There is no guarantee that the estate tax exemption will stay high forever. As families work with their financial advisors, the next two years are an important window to plan ahead. The upshot of the new law is that high net-worth taxpayers now have more time to thoughtfully consider estate planning strategies, including charitable giving. For nonprofit organizations, this means continuing to focus on long-term planned giving strategies is wise.

| The team at the Community Foundation is honored to serve as a resource and sounding board as you build your charitable plans and pursue your philanthropic objectives for making a difference in the community. This newsletter is provided for informational purposes only. It is not intended as legal, accounting, or financial planning advice. Please consult your tax or legal advisor to learn how this information might apply to your own situation. |

On February 26th, Berks County Community Foundation held a reception at Vintner’s Table in Wyomissing, attended by over thirty-five professional advisors. The event was an opportunity for us to thank the professional advisors who, by introducing the Community Foundation to their clients, allow us to continue our mission of promoting philanthropy and improving the quality of life for Berks County residents.

Other staff members present included Kevin K. Murphy, President; Monica Reyes, VP for Programs & Initiatives; Molly McCullough Robbins, VP for Philanthropic Services; Erica Caceres, Communication Manager; Vivi Anthony, Executive Assistant, and our team of program officers.

Cindy Milian, Health and Human Services Program Officer, oversees grants for individuals, public health initiatives, human services initiatives, and animal welfare.

Emily Smedley, Environment and Energy Program Officer, manages programs and grants related to the environment, sustainable energy, land use, and neighborhood vitality.

Kim Sheffer, Lifelong Learning Program Officer, manages the scholarship and educational grant funds.

We enjoyed the chance to mingle with our professional advisor friends and provide updates on Community Foundation work in the community.

Since the Community Foundation was founded over 30 years ago, 50% of the charitable funds we manage have been the direct result of a referral by a professional advisor. In dollar amounts, 76% of our current investment pool is the result of funds referred to us by a professional advisor.

Details on how you can be a referrer and spark change are available in the Community Foundation’s Giving Guide.

If you have questions, please email me at frankia@bccf.org.

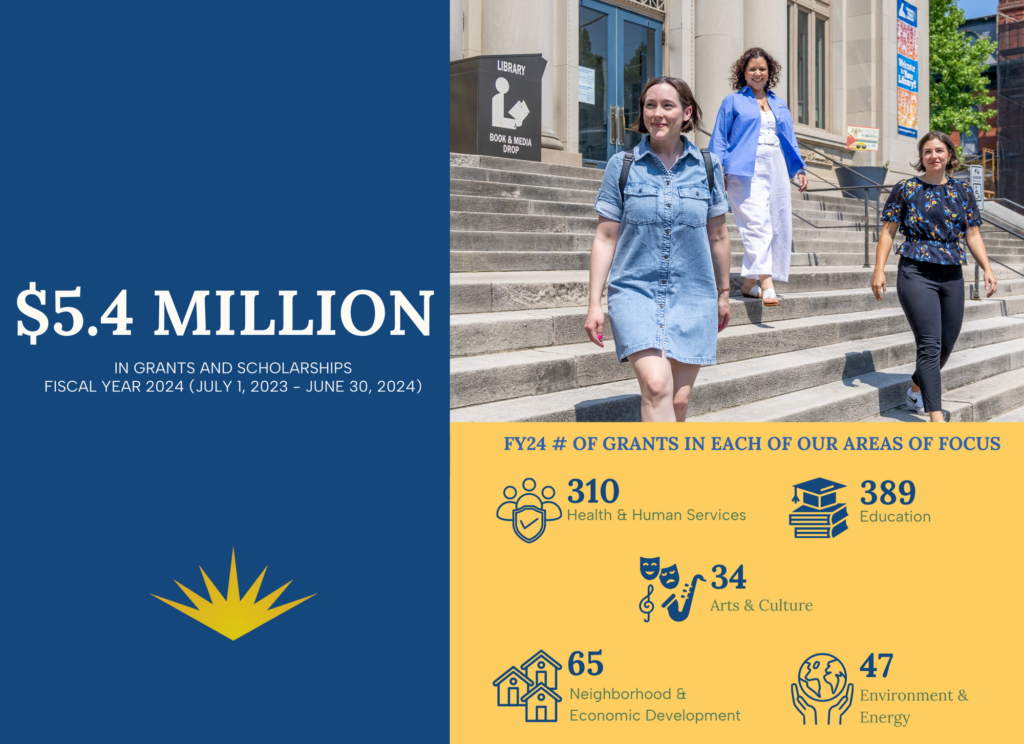

In Fiscal Year 2024, Berks County Community Foundation distributed $5.4 million in grants and scholarships to support the community. The year was filled with innovative projects, impactful programs and a strong commitment to our mission.

Berks County Community Foundation helps donors fulfill their charitable desires. The Foundation was established in 1994 as a non-profit, public charity to provide a locally managed resource for establishing endowments. We have program officers on staff who are experts in their focus areas – energy & environment, lifelong learning, health & human services, the arts, and neighborhood & economic development. They steward these charitable funds to ensure that the grants and scholarships awarded from them are making an impact and fulfilling our donors’ wishes.

“The work we do isn’t only about working with donors to establish funds. Nor is it just about awarding grants and scholarships. The team at the Community Foundation convenes local leaders, research national and local trends, and chooses initiatives on which to focus so community conversations get moving and big ideas are discussed”, Kevin Murphy, president says.

The Annual Report highlights our mission of promoting philanthropy and improving the quality of life for the residents of Berks County. The team works hard to bring organizations and individuals together for collaboration to spark change in the community. This year’s Annual Report provides detailed stories and data behind these achievements, underscoring the powerful impact of donor support in the community.

To read the full report, take a look below or click here.

On February 28th, Berks County Community Foundation held a Winter Get Together. Over 30 professional advisors attended the event, which included a roll-out of our updated Giving Guide.

The Giving Guide is a comprehensive resource designed to explain what a community foundation is and the advantages of using Berks County Community Foundation. The guide includes explanations on the various types of funds one can establish, how to create a charitable fund, and more.

Introductions to the program officers and their areas of focus were part of the evening’s festivities, in addition to introducing a new face, Molly McCullough Robbins.

Robbins comes to the foundation as the Vice President for Philanthropic Services handling resource development and promotional efforts of the foundation. Robbins will work with the program officers to identify individuals in the community who may be interested in supporting the foundation’s work.

- Cindy Milian, Health and Human Services Program Officer, oversees grants for individuals, public health initiatives, human services initiatives, and animal welfare.

- Emily Smedley, Environment and Energy Program Officer, manages programs and grants related to the environment, sustainable energy, land use, and neighborhood vitality.

- Kim Sheffer, Lifelong Learning Program Officer, manages the scholarship and educational grant funds.

The event was also a chance for us to thank the professional advisors who, by introducing the Community Foundation to their clients, allowed us to carry on our mission of promoting philanthropy and improving the quality of life for Berks County residents.

Since the Community Foundation was founded 30 years ago this year, 50% of the charitable funds we manage have been the direct result of a referral by a professional advisor. If we look at the dollar amount of those funds referred to by a professional advisor, it is 76% of our current investment pool.

Details on how you can be a referral and spark change are available in the Community Foundation’s Giving Guide.

If you have questions, please email give@bccf.org.

For nearly 30 years, Berks County Community Foundation has helped individuals, families, organizations, and businesses achieve their charitable objectives. We know that change radiates outward, and we help people in creating a legacy and a brighter future for all of us. This often includes creating a fund to honor the memory of a loved one or support a cause about which the individual or family cares deeply. In either case, a member of our staff works with the people involved to determine the best way to meet their charitable objectives.

How does it work? First, think about what you are passionate about supporting. We can help you achieve your charitable goals, no matter the cause or motivation. Let us help you discover the type of charitable fund that best matches your goals.

Different funds fulfill different dreams.

Which of these types of funds works best for your dream?

- Undesignated: Want to meet the most pressing needs in Berks County? Grants from undesignated funds are determined by our board of directors to address ever-changing community needs.

- Designated: Support a cause or specific organization year after year, even after you are gone. Organizations benefit from consistent support, and you can be confident the money in your fund is professionally managed.

- Field of Interest: Whatever your cause, our team of program experts will do the legwork to ensure grants from your fund make a difference for your cause now and for years to come.

- Donor Advised: Make decisions about where grants from your fund go each year while you are alive, with the option to name a successor advisor after you are gone.

- Scholarships and Awards: Help students pay for their education through a scholarship fund, honor people for significant accomplishments by establishing an annual award or use a designated fund or field-of-interest fund to support a specific school or area of education.

Ready to put your charitable vision into action? We are here to help. Click here to use our short questionnaire to set your journey of generosity in motion. Questions? Email give@bccf.org. – We look forward to helping you fulfill your charitable goals.

Every year, Rutter’s organizes a Secret Santa event where they select 100 employees throughout the company to decide where to donate $1,000. This holiday season, Matthew Commons was one of the lucky individuals to donate to a charity of his choice.

Matthew decided the donation should go to a fund at Berks County Community Foundation. “What better way to give back to my community than choosing the foundation that goes above and beyond to support every aspect of the place I grew up in?”

The impact of Matthew’s choice reaches far beyond the monetary value of the donation.

Matthew decided the donation should go to a charitable fund that supports local businesses. The donation will be put into the Business Jump Start Incubator Fund. This fund supports startup businesses. Startup businesses pay a reduced rent and in return get a fully furnished office, Wi-Fi, and use of the conference facilities. By supporting local businesses, Matt is contributing to the economic impact of the community.

Matt’s story serves as an inspiration for us all. It reminds us that change starts with a spark. Your spark. And every act of generosity, when directed with purpose, can have a profound impact on the lives of those around us.

Want to make a positive difference in Berks County? We’re happy to answer your questions, discuss charitable options with you, and do everything we can to ensure your charity objectives are fulfilled. We’d love to chat. Contact us today.

For nearly three decades, I’ve had the joy of meeting with individuals and families as they write their wills – usually with the help of their lawyer – and listening to them describe the people who are or have been important to them in life. Of course their parents, siblings, or children are often mentioned, sometimes a beloved teacher or coach.

Taking the time to create a will can feel daunting, but one way to make the task more interesting is to consider whether – and how – you’d like to give back to your community after you’re gone. That’s where we come in. Berks County Community Foundation offers a unique and powerful way for individuals to make a lasting impact in their community by creating a charitable fund through their will.

Creating a fund through a will is an easy and meaningful way for you to support causes and organizations that align with your values and passions. This can be done by including a provision in the will that directs a specific asset or portion of the estate to the Community Foundation, which will be used to establish a named fund in your memory or in honor of a loved one.

The process of creating a fund through a will is relatively simple. You can work with your attorney to include language in your will that directs assets to the Community Foundation. You can also consult with our staff to determine the most appropriate type of fund for your charitable interests and goals. Once the will is executed, we’ll work with your executor or personal representative to establish the fund according to the instructions provided in the will.

The benefits of creating a fund through a will at the Community Foundation are numerous. Not only does it provide a way for you to make a lasting impact in your community, but it also offers a range of giving options, such as unrestricted funds, field of interest funds, and designated funds. This allows you to support a specific cause or organization, or to give the Community Foundation the flexibility to respond to the changing needs of the community over time.

In addition to the charitable benefits, creating a fund through a will also provides a number of personal benefits. It can help to ensure your assets are distributed according to your wishes, and it can provide a way for you to leave a lasting legacy in memory of a loved one. It can also be a way for you to make a difference in the lives of others, even after you are gone.

Overall, creating a fund through a will at the Community Foundation is a powerful way to make a lasting impact in your community. It’s easy to set up and provides a range of giving options, allowing you to support the causes and organizations that are important to you while also leaving a lasting legacy.